The contents of this article are accurate at the time of publishing, are for general information purposes only, and do not constitute investment, legal, tax, or any other advice. Before making any investment or financial decision, you may wish to seek advice from your financial, legal, tax and/or accounting advisers.

As we approach the end of the 2022-23 tax year, investors may be interested to note the UK Government’s decision to reduce the Capital Gains Tax (CGT) allowance – the first such reduction in decades. In a move that will affect private clients and trusts, the annual exemption threshold – currently £12,300 for private individuals[1] – will fall to £6,000 on 6 April 2023, and then to £3,000 in the tax year 2024-25[2].

CGT was first brought into the UK tax regime in 1965. The tax ruling was thought to be directly influenced by the burgeoning rise in UK property prices after the Second World War. The CGT exemption amount is usually indexed higher each tax year to account for the general rise in prices and wages – inflation. The allowance is intended to encourage investment and entrepreneurship, and thus maintaining it in ‘real’ terms was done to spur activity in the economy.

As explored in our article following last year’s Autumn Statement, the change in the CGT tax regime may result in investors bringing forward plans to realise gains in portfolios and perhaps seek further methods of diversification. Equity markets have rallied since Q4 2022, and particularly since the Christmas trading period, whilst, at the same time, interest rates have risen sharply in the Western world. As a result, some investors might seek to realise long term equity gains and diversify into alternative assets, such as gold and other precious metals.

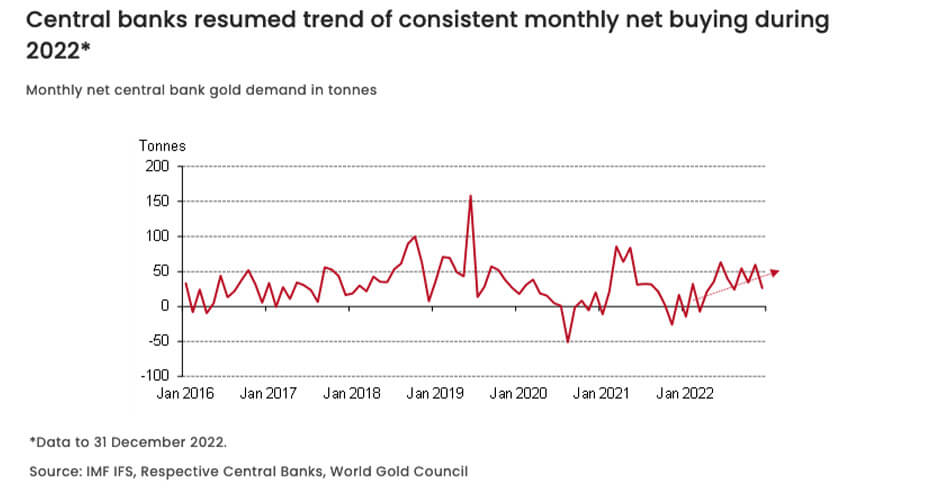

Notably, between Q1-Q3 2022, central banks globally accumulated gold reserves at a pace not seen since 1967, when the US dollar was still backed by the gold standard. In fact, the build-up of gold reserves over these three quarters was greater than any annual total since 1967, and this growth has continued to the current date. Whilst the sterling and dollar gold prices are trading around all-time highs, there may be a slight pause in price appreciation as the market consolidates. In turn, this could be seen as an opportunity for new investors to enter the market as tax year end planning takes shape.

With the sequential reduction in CGT allowance, investors may wish to explore other CGT-efficient assets. Gold, silver and platinum bullion coins from The Royal Mint are CGT exempt, due to their status as UK legal tender, and are also popular with investors across the world due to their timeless design, historical importance and enhanced security features. You can read more about bullion coins and Capital Gains Tax in our article.

Pension planning also comes into view at the end of the tax year. Our Gold for Pensions offering allows our clients to add to their gold holdings via a Self-Invested Personal Pension (SIPP) or a Small Self-Administered Scheme (SSAS). Pensions can provide a means of tax-advantaged and long-term investment for individuals to plan their finances into retirement. Holding physical gold assets under this offering in The Vault®, our high-security facility in South Wales, mitigates the systemic risks found in the banking system; a previous example of this is overleverage leading to a ‘credit crunch’. With Gold for Pensions, investors can diversify their portfolio, offering peace of mind.

References:

[1] This does not apply to trustees and personal representatives, who are entitled to 50% of a private individual’s CGT exemption amount.

[2] Reducing the annual exempt amount for Capital Gains Tax - GOV.UK (www.gov.uk)