When discussing precious metals, gold and silver often go hand in hand. Both metals have been coveted for thousands of years, and each has been found on every continent of the world. Much like gold, silver is prized as an investment option and is often used for coins, bars and jewellery. However, silver also has a multitude of unique technical, industrial and medical uses, making it an interesting metal to own and invest in.

Uses of Silver

Some of the unique properties of silver mean that the industrial uses are greater than the uses for gold. Whereas less than 10% of the gold mined is used in industry, more than 50% of silver is destined for industrial use. This is partly because silver has some unique chemical properties, including being a strong thermal and electrical conductor. In addition, the uses for silver are also in the medical industry, as it is actually one of the few metals with anti-bacterial properties. These strong links to industry mean that demand for silver often correlates with industrial demand. This, therefore, means that the price of silver can be linked to overall economic output.

Having said that, although silver is indeed a highly prized metal that has much in common with gold, the prices of the two metals could not be more different, especially when you compare them. Many use the ‘gold-silver ratio’ to compare how each of the prices are performing in relation to one another, and this shows that, despite the many uses for silver, the price has never achieved more than a tenth of the value of gold. However, for the precious metal investor, the low price of silver means that it is far more accessible than gold, resulting in many choosing to start their precious metal investment journey with the cheaper alternative.

History of Silver

Why invest in Silver?

Much like gold, silver has been used as both a store of wealth and a form of exchange and currency for many years. However, whilst gold is usually mined at dedicated gold sites across the world, silver is actually a by-product of zinc, copper and lead mining. This means that, unlike gold, the output of silver usually exceeds what would have been recovered on the basis of silver demand alone. Demand for silver is one of the main drivers which affects the silver price, so it is an important consideration for investors when contemplating buying it. Due to a much wider range of uses, in percentage-terms, the price of silver can vary considerably, as the price of gold has historically moved much slower. Nevertheless, it is still used by many as an investment option, and can form an important part of your portfolio.

Some suggest that silver is used by investors who are slightly less risk averse. This is because diversifying your portfolio with silver can also offer the potential benefits of the larger price movements which come with the silver market.

In the same way that people invest in gold to diversify their portfolio from stocks, shares and bonds, silver is also used by investors to diversify because, much like other precious metals, silver can provide a low negative correlation to other assets. Because of this, adding silver to your investment portfolio can decrease risk overall.

Silver and VAT

One of the perceived down-sides of silver is the fact that, in part, due to the industrial and technical uses, purchases of silver are liable for VAT. This is currently charged at the standard rate of 20% in the United Kingdom. Although this could be seen as a barrier to entry for some, due to the large price movements of silver already mentioned, this 20% cost could be absorbed by some of the percentage gains which we see in the silver price. For example, from the start of 2020 to the start of 2021, silver rose from £13.58 to £19.95 – an increase of nearly 47%. Even if the initial VAT cost is factored in, this could be seen as a significant return.

How can I Invest in Silver?

As with other precious metals, there is a wide range of options for investing in silver and adding it to your portfolio. Although traditionally available in coins, bars, jewellery and perhaps even antiques, silver is also available to trade on digital trading platforms, allowing easy access to the silver precious metal markets.

Silver coins are available in a wide range of sizes and designs. As well as the more established Britannia silver coins from The Royal Mint, more recently other ranges have also gained popularity, most notably the Queen’s Beasts range of silver bullion coins. Due to the lower initial costs than their gold counterparts, silver bullion coins are often prized by collectors, as well as investors, so some investors choose silver to allow them to collect a broader range of themes and designs.

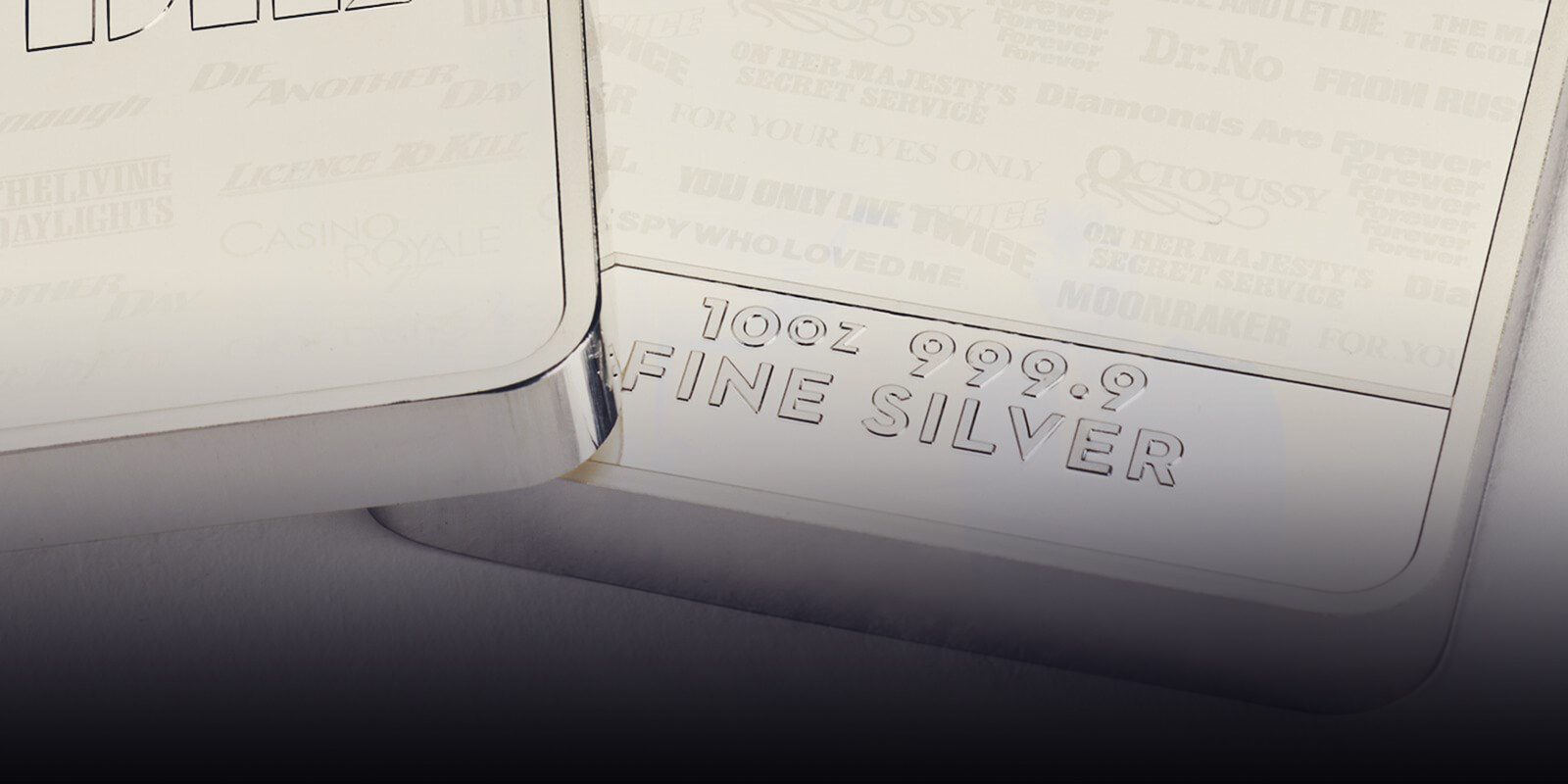

Silver bars are also available and tend to be popular among those who wish to invest in larger quantities.

Storage of Your Silver Investment

When compared to gold, as silver is cheaper, larger quantities can be obtained for the same outlay, so for some, storage may be an issue. If you are choosing to diversify your portfolio by adding silver to your gold investments, an important point to consider is that silver cannot be stored alongside gold, as the silver will tarnish. Although many will still choose to store their silver investments at home, in an insured, safe location for convenience and security, many still choose to store their investments with another custodian - for example, The Royal Mint’s vault. There is, of course, a storage fee to pay if you choose to store with someone else. However, this may be less than purchasing your own safe and insurance at home, and ultimately depends on your own circumstances and preferences.

Digital Silver

As well as the option to purchase coins and bars, many investors choose the convenience of investing in digital silver products. The Royal Mint, for example, through their digital precious metals platform allows you to purchase silver from as little as £25. Although silver coins can be purchased for a similar modest outlay, one of the benefits of digital silver investments is the convenience of storage, insurance and guaranteed sell back. From within your account area, you are able to buy and sell investments 24 hours a day, and because the price of silver can change within a short space of time, many choose this service so that they can quickly benefit from changes in the spot price.

Our Silver Investment Options

Make Your Investment Precious

Silver Bullion Bars

Discover Our Range

Silver Bullion Coins

Discover Our Range

Digital Silver

Find Out More

Investment Services

Find Out More