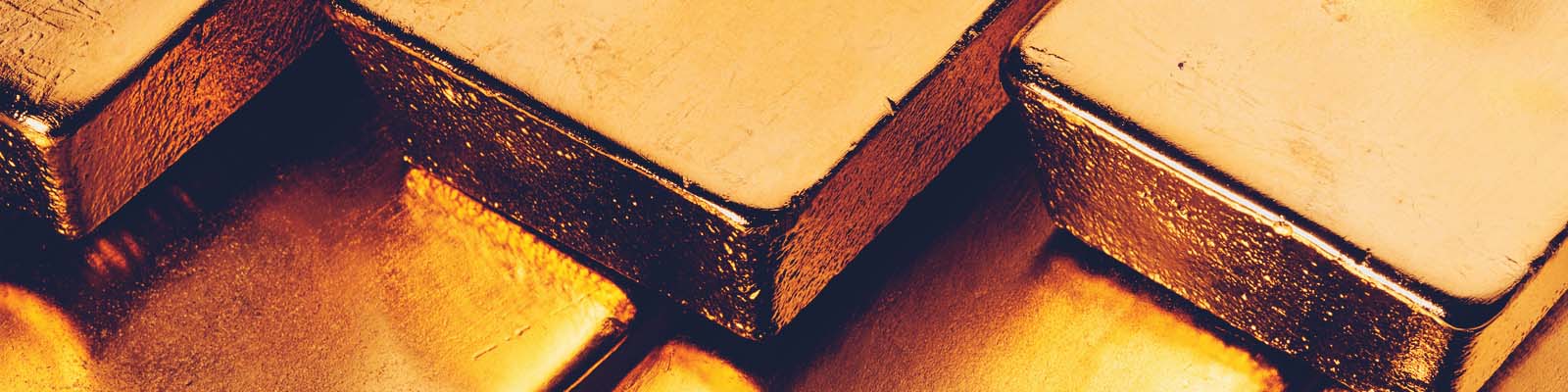

Precious Metal Prices

June opened with a gold price of $1,829.70 and prices steadily increased throughout the first half of the month as they met, and occasionally broke, the $1,850 barrier. The platinum price also saw a reasonable amount of activity in the first few days of June, from a low of $975 on 1 June, to a high of $1,031 less than a week later.

However, by the beginning of the third week, prices for both gold and other precious metals suffered sharp declines. As the dollar began to strengthen, and seek further support, ongoing discussions regarding a sharp interest rate hike by the US Federal Reserve eroded the appeal of bullion and precious metals. Gold suffered losses of around 2%, while platinum saw 7% declines as the dollar index hit a multi-decade peak.

Inflation and Market News

On 15 July, the US Federal Reserve announced an increase in interest rates by 0.75 percentage points as a means of combatting inflation. This announcement by the Fed goes against the comments we reported last month from Fed Chair Jerome Powell, who then commented “Fed officials have no plans to boost rates by three-quarters of a point at any meeting” and declared it is “not something (the Fed’s policymaking committee) is actively considering”. The Bank of England also responded by increasing their interest rate the following day by 0.25 percentage points.

The Labor Department reported that the annual inflation rate in the US rose to 8.6% in May, after initially easing in April, as rising prices for energy and food continue to prove a burden to consumers. Inflation in the US is currently at the highest rate for over 40 years, much of which was prompted by an unexpectedly strong economic rebound following the shock of the pandemic that exhausted supplies prompting companies to raise prices as a result. The ongoing conflict in Ukraine has also contributed to a rise in commodity prices, which has led to fears that an economic downturn could be on the cards in the coming weeks and months.

News of the rises caused shockwaves through the financial markets. The S&P 500 benchmark was trading 21.8% below its January peak whilst tech stocks, such as the Nasdaq fell 4.6%. Cryptocurrency markets didn’t escape the declines either, as Bitcoin suffered another devastating sell-off sending the price down 12%. This surge in inflation could contribute to gains in gold in the longer term as, although we have seen recent declines, gold is still said to have outperformed stocks and bonds this year. Juan Carlos Artigas, World Gold Council’s global head of research commented: “The Fed is going to try to tame inflation, but even with higher rates, that will be difficult.”

Central Bank Gold Purchases

The World Gold Council (WGC) released their Annual Central Bank Survey in early June with several key insights into the sentiment of central banks across the world and their attitude towards precious metals. In short, gold continues to be viewed favourably by central banks as a reserve asset with 61% of respondents saying that they have plans to increase their gold reserves over the next 12 months - an increase from 52% last year.

In line with the release of the central bank survey data, the WGC also released their monthly central bank purchase and sale data for April. This information showed that four banks contributed to gross purchases of 20.5t in April: Uzbekistan, Kazakhstan, Turkey and India, with Uzbekistan making the largest purchase of 8.7t.

Sales were limited to a small number of central banks, each of which totalled less than a tonne. On a year-to-date basis, Egypt still proves to be the largest gold purchaser of 2022 following a significant 44.1t addition to their reserves in March.

Another notable development was an interview with incoming governor of the Czech central bank, Ales Michl who laid out plans to significantly increase the countries gold reserves from 11 tonnes to 100 tonnes or more. The justification for this near 10-fold increase was part of a proposed strategy to increase the expected return on official reserves with an aim to make the bank ‘profitable’ in the long term. He also commented that these purchases will be gradual, and that gold is ‘good for diversification’.

PGM Metal Demand

The World Platinum Investment Council (WPIC) suggested in a recent report that a recent increase in lease rates for platinum suggests that there may be a shortage of platinum available on the spot market. Similar movements have been noted previously which were said to be due to Covid-related disruptions. However, as Russia is a large producer of the precious metal, the ongoing uncertainty regarding the availability of platinum of Russian origin could lead to further movements in the platinum price.

Platinum is currently used extensively in catalytic converters in both petrol and diesel vehicles. However, vehicle manufacturers are said to be currently investigating the potential of substituting platinum for palladium in petrol vehicles to further reduce reliance on Russian supplies.

The WPIC also reported that although forecasts are for traditional petrol or diesel vehicle productions to decline, demand for platinum is set to increase in the short to medium term from current levels of 3,055 koz to a peak of 3,819 koz by 2028 before declining thereafter. One of the factors influencing this rise in the short term was the ongoing political and environmental pressure on vehicle manufacturers to reduce emissions.

Chinese Gold Demand

A recent report from the World Gold Council suggested that despite recent declines in the Shanghai Gold Benchmark and the LBMA Gold Price, the Shanghai-London gold price spread turned positive as local demand began to recover. Looking ahead, as major Chinese cities emerge from the recent Covid-19 resurgence, China has rolled out various economic stimulus measures including rate and tax cuts as well as consumption vouchers and electric car subsidies. As a result, local gold demand is likely to improve over the coming months following the economic recovery which should ensue.

The Royal Mint

In celebration of Her Majesty The Queen’s Platinum Jubilee, The Royal Mint has produced its largest-ever coin – a unique 15-kilogram gold masterpiece commissioned by a private UK collector in recognition of Her Majesty’s historic 70-year reign. The coin, which has a diameter of 220mm, is made of fine gold and has been hand-crafted to the highest standard, featuring a special-edition commemorative design on both sides that has been personally approved by The Queen.

With a face value of £15,000, the making of the Platinum Jubilee of Her Majesty The Queen’s 15-kilo gold coin required almost 400 hours of craftsmanship and refinement, and state-of-the-art engraving and laser technology. Rather than being struck between two dies like a standard coin, this rare large coin was cut into a solid gold ingot by a high-speed precision milling machine, before the processes of burnishing, polishing, and frosting are carried out by hand to highlight key elements within the designs.