Article source here, written by Jake Coulson.

Gold has long endured as a store of value, and as such, has continued to be an essential part of many investors’ portfolios. Of late, the world has largely been pushing to decarbonise, and investors have begun to follow suit when it comes to the sustainability of their portfolios, raising questions around the carbon intensity of gold.

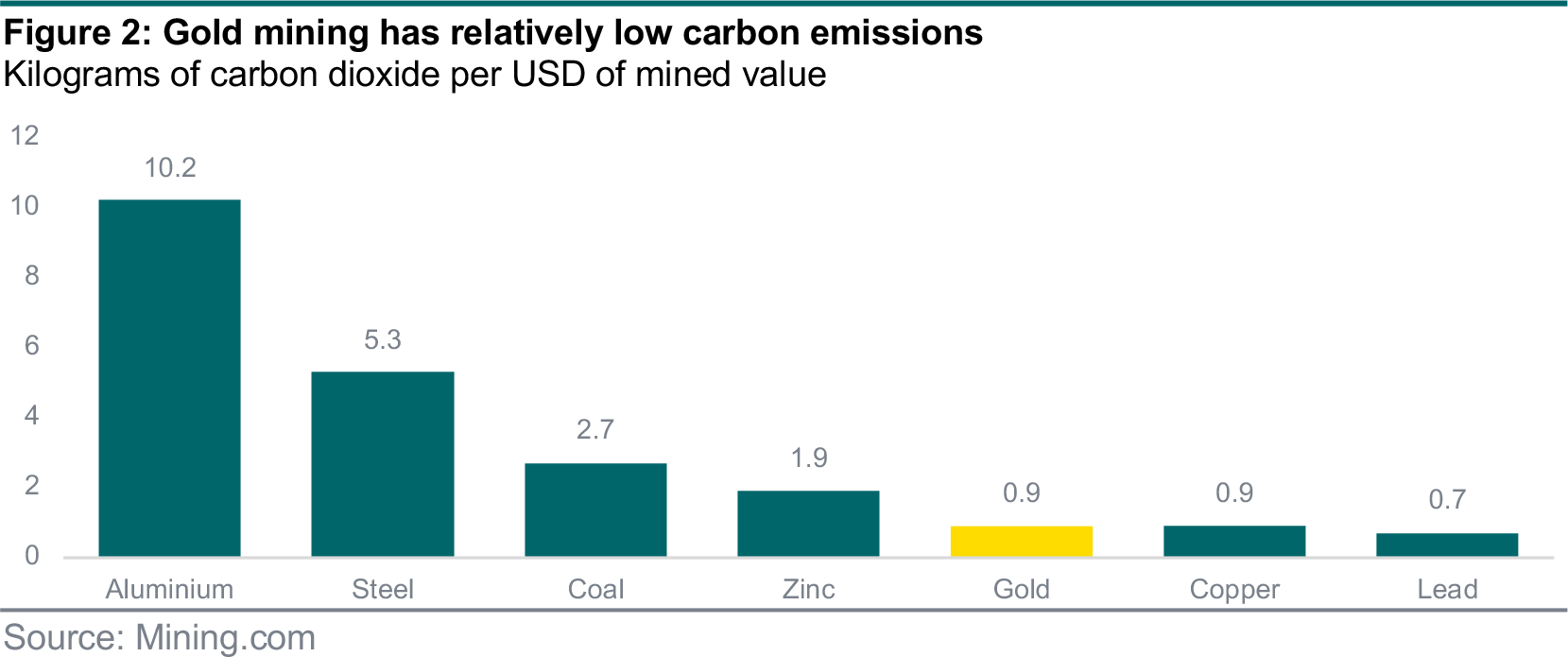

The majority of gold comes from mining, accounting for around 75% of global production annually. While gold mining is already on the lower end of carbon emitters, compared to other major materials, it is still a carbon intensive process. It requires great amounts of energy and shifting large volumes of earth – it takes 1,250,000kg of natural material to produce 1kg of pure gold.

Source: Mining.com. For illustrative purposes only.

A possible solution to this is focusing on the best-in-class ESG gold miners, that are sourcing their gold responsibly, and sustainably. This can reduce the relatively low carbon intensity of gold mining even further, limiting the emissions footprint of an investors’ portfolio.

“Recycled gold, some have argued, is the ideal way to access sustainable gold – especially given the fact it is over 90% less carbon intensive than mined gold.”

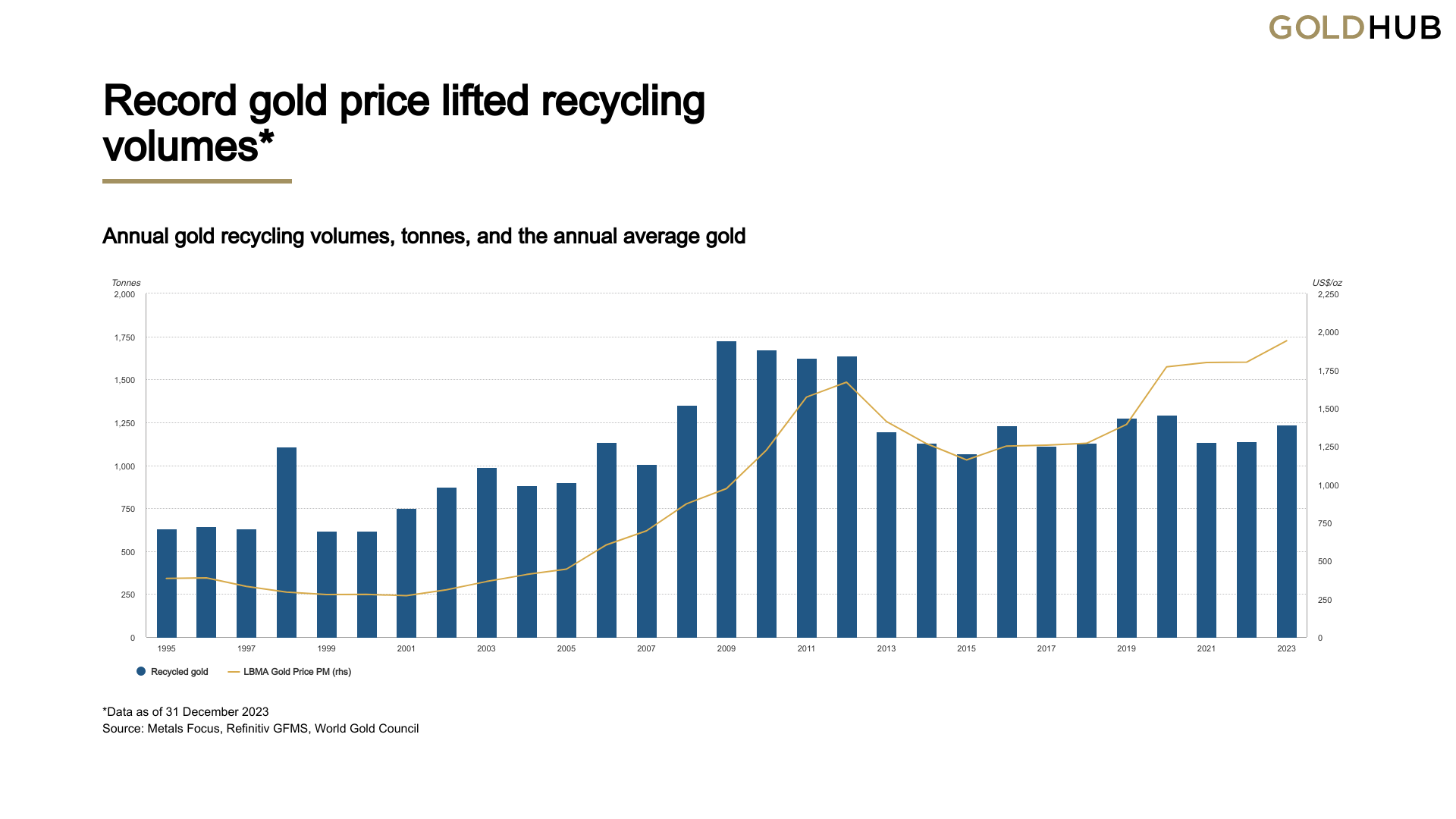

Mining is not the only source of gold, however. Around a quarter of global supply comes from gold that has already been extracted from the ground. Recycled gold, some have argued, is the ideal way to access sustainable gold – especially given the fact it is over 90% less carbon intensive than mined gold.

Given gold is infinitely recyclable, it seems like a no-brainer. As such, we’ve seen large brands like Apple, Samsung, and Pandora announce the use of recycled gold in their products – with the latter aiming to use recycled gold exclusively by 2025. According to the World Gold Council, the supply of recycled gold increased 9% year over year to 1237t in 2023.

Source: Metals Focus; Refinitiv GFMS; World Gold Council. Data as of 31/12/2023. For illustrative purposes only.

But criticism has mounted around the traceability of recycled gold. As companies eagerly look to recycle more and more gold to lower their carbon footprints, the risk grows that gold from irreputable sources may enter the ecosystem.

Picture a lump of gold mined illegally, by an operation with no regard for ESG principles, being recycled into a fresh gold bar with a new stamp, with its questionable origins now unrecognisable. How can you tell if the freshly minted gold bar has a far less glowing past? This has been termed by some as “gold laundering”.

These concerns are not without merit, and investors are right to be wary of traceability when it comes to gold investing. At HANetf, we believe we have a solution to this.

In 2020, we partnered with The Royal Mint – the official maker of British coins since its origins in c.886 AD – to create The Royal Mint Responsibly Sourced Physical Gold ETC (ticker: RMAU). All of the gold within the ETC is custodied by The Royal Mint, at their highly secure vault in Llantrisant, Wales.

Crucially, all the gold is London Bullion Market Association (LBMA) post-2019 responsibly sourced good delivery bars – the highest available standard – ensuring that the gold is fully traceable, and ethically sourced.

But beyond this, over half of the gold held by the ETC is 100% recycled gold, thanks to The Royal Mint’s partnership with Quintet Private Bank. This gold is not recycled from multiple sources, but purely from scraps in The Royal Mint’s manufacturing process. This creates a closed circuit – a circular ecosystem whereby only pre-approved, responsibly sourced gold is recycled into new bars.

This greatly reduces the carbon intensity of the gold, but also ensures it is traceable, and that its lifecycle is transparent. Investors can rest assured that the gold they are investing in has been thoroughly vetted, and that the recycled bars are minted from gold that has already been approved and certified.

The bottom line is – recycled gold can undoubtedly reduce the carbon intensity of investors’ portfolios, but it is essential to ensure that the circular economy is truly circular, with no potential for tainting.

RISKS

Investors’ capital is at risk and investors may not get back the amount originally invested and should obtain independent advice before making a decision. Any decision to invest should be based on the information contained in the relevant prospectus. ETC securities are structured as debt securities and not as shares (equity).

Notes

The contents of this article are accurate at the time of publishing, are for general information purposes only and do not constitute investment, legal, tax or any other advice. Before making any investment or financial decision, you may wish to seek advice from your financial, legal, tax and/or accounting advisers.

This article may include references to third-party sources. We do not endorse or guarantee the accuracy of information from external sources, and readers should verify all information independently and use external sources at their own discretion. We are not responsible for any content or consequences arising from such third-party sources.