Last updated January 2023

Individual Savings Accounts

Individual Savings Accounts (ISAs) have been a staple method of saving since their launch in 1999. ISAs come in various forms, including cash ISAs, junior cash ISAs, stocks and shares ISAs and lifetime ISAs. They provide savers with certain tax benefits and are favoured by many because they tend to be low risk. With an ISA, your savings – up to a certain threshold – are kept in a bank or building society and no tax is paid on the interest accrued. ISAs are covered by the Financial Services Compensation Scheme (FSCS), which protects savings of up to £85,000 if the bank or building society fails.

In recent years, however, a combination of low interest rates and rising inflation has hit traditional savings accounts such as ISAs. In comparison, economic uncertainty and geopolitical volatility has driven demand for gold globally, causing the value of gold to increase in response.

The Rise of Digital Gold Savings

Increasingly, savers are opting for digital gold accounts. Although not covered by the FSCS, digital gold is particularly popular with people who wish to diversify their overall savings portfolio, and to include gold within their holdings without taking physical delivery of bars or coins.

Buying gold ‘digitally’ allows you to buy a fraction, or portion, of physical gold bars. At The Royal Mint, all of our digital gold is backed by LBMA-approved cast gold bars, which are fully insured and stored at our world-class secure facility, The Vault®. The weight of the gold is wholly owned by the customers. We simply store it; we have no legal claim over it. The Vault is audited regularly by an independent third party.

Long-Term Performance: Gold vs ISAs

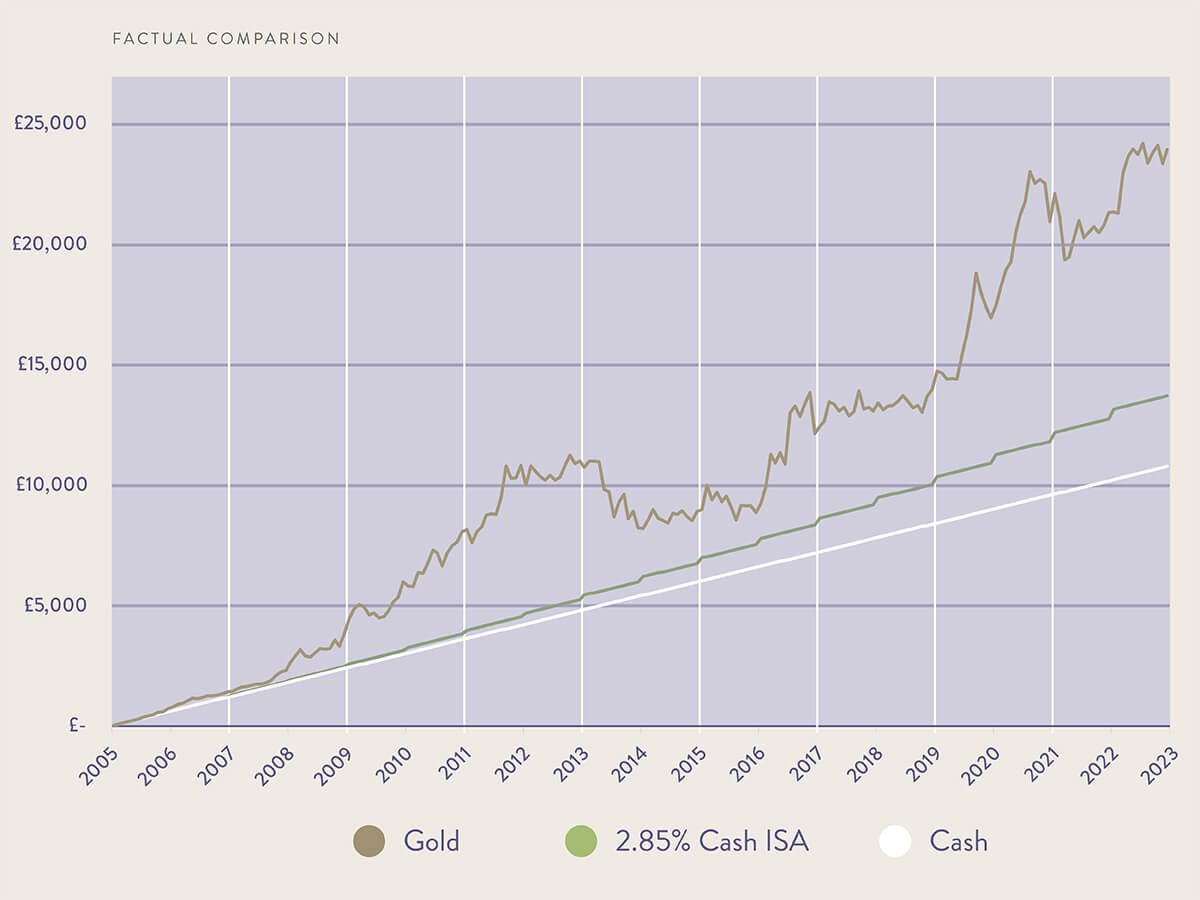

In terms of performance, gold has achieved substantial gains over the last 18 years, providing better growth than traditional savings options. We compared the gains made from a saving of £50 per month in a gold investment to the hypothetical gains from the best cash ISA available to the open market at a rate of 2.85%[1] (note that this rate wasn’t available for much of the 18-year period, so this is an example based on how the best available current rate would have performed). The gold rate is based on the first LBMA PM fix of the month, which is the latter of two daily price calculations.

Setting aside £50 cash per month for 18 years, with no interest, would result in a sum of £10,800. In comparison, putting the same amount into the best cash ISA would have yielded £13,722.30, whilst a gold investment would have grown to £23,951.54.[2]

The Benefits of a Digital Gold Savings Plan

Regular Savings

As with cash ISAs, many gold savings programmes allow you to set up regular, recurring payments into your precious metals account. This allows you to buy and save gold every month, as well as making one-off purchases whenever you choose. The minimum amount for the monthly payments is usually relatively small; at The Royal Mint it starts at just £25. You can arrange a standing order or simply fund your account via bank transfer or debit card, then funds from your online wallet will be used to buy a set value of gold each month.

Tax Benefits

Digital gold savings and ISAs both attract various tax benefits, but the gains and the risks associated with each are very different. Whilst ISAs can benefit from exemptions in income tax and Capital Gains Tax (CGT), gold bullion is VAT-free in the United Kingdom.

Flexibility

Unlike ISAs, which have a limit of £20,000 per tax year, there is no upper limit to the amount of digital gold you can purchase. This enables investors to react to the market and buy whenever favourable conditions arise. In addition, you can decide exactly when you want to sell. There is no reliance on the banking system or other financial institutions, as you are in complete control of the gold that you own.

Have you Considered Investing in Gold?

As rare as it is beautiful, gold has been viewed as a store of wealth for thousands of years. Today, it is popular with not only individual investors but also central banks, as governments choose to safeguard their national reserves. In fact, during 2022 central banks globally amassed gold reserves at a pace not seen since 1967, demonstrating its ongoing allure.

If you’re considering getting into digital gold, we offer a range of ways in which you can start saving:

- Our DigiGold savings plan is suitable for investors who wish to actively trade and save gold at the click of a button.

- Little Treasures is designed for parents, grandparents and other family members who wish to start a nest egg for a loved one.

- Gold for Pensions allows you look after your future by adding gold to your Self-Invested Personal Pension (SIPP) or your Small Self-Administered Scheme (SSAS).

Please note that this information should not be construed as financial advice. For full terms and conditions, please visit our Disclaimer page: https://www.royalmint.com/disclaimer/

Sources:

[1] According to MoneySavingExpert, the best rate available on 26 January 2023 was 2.85% from Cynergy Bank.

[2] Calculated using the last business day of 2022 and the first calendar day of 2023. Based on interest on the cash ISA being paid yearly in month 12, and that money saved or invested on the first business day of the month. These figures are exclusive of additional precious metal purchase and storage fees.