Investors Eye Alternatives in Choppy Global Financial Markets

The Royal Mint

September 2023

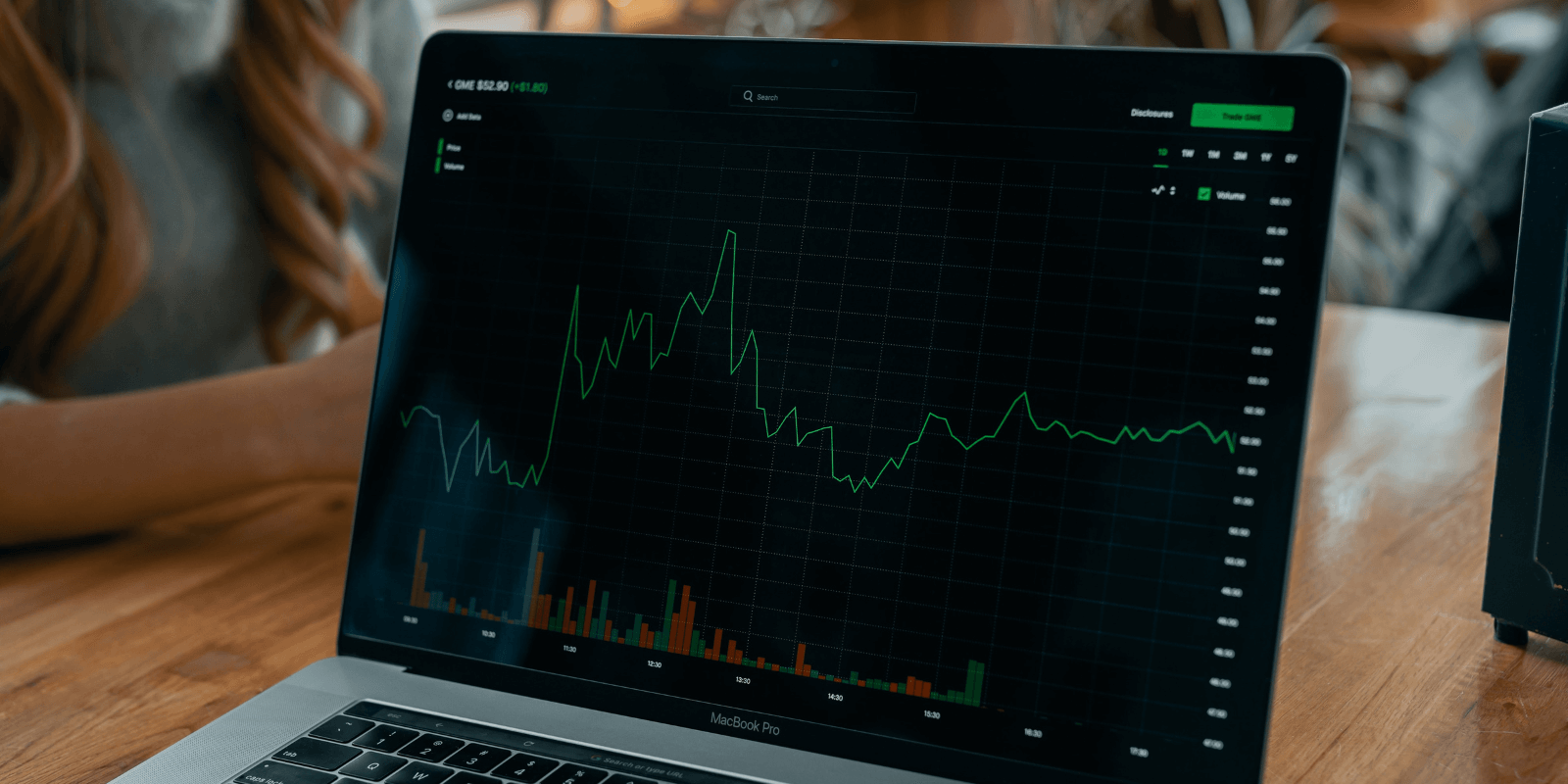

Recent macroeconomic uncertainty and volatility in global financial markets has had a significant impact on the decision-making of investors. Investors are adapting to a rapidly shifting economic and geopolitical backdrop which is prompting many to become more risk averse. UK investors are staying in the market, but many are resetting their portfolio and expectations to reflect a changing environment.

The global economy is in a very different place to where it was 12 months ago. Leading central banks have increased interest rates to levels not seen since the start of the Global Financial Crash as inflation remains stubbornly high. Global economic growth has been sluggish against the backdrop of the war in Ukraine and an economic slowdown in China. Cash flow issues for high-growth firms has led to the demise of financial institutions such as Silicon Valley Bank and Credit Suisse with reverberations continuing to be felt across the technology sector.

These headwinds have resulted in volatility across financial markets. As a result of this, investors are now readjusting their portfolio to change with the times. Our data shows that over two-thirds (71%) of UK investors surveyed are looking for better returns from their investment portfolio as inflation erodes the value of cash. Nearly three-quarters (74%) plan to invest the same amount or more each month as many invest spare cash and try to build their pension pots. This is a reminder that many investors believe market uncertainty hides an opportunity that just needs to be found.

Whilst this turbulent period weighs on investors, many are finding their feet with alternatives to traditional investments such as stocks and bonds. Alternative investments such as crypto and gold are now a common feature of portfolios in the UK as investors become eager to put their hard-earned funds to work and cushion their wider portfolio against potential losses. As ever, investors remain pragmatic.

|

What is an alternative investment?Alternative investments are categorised as financial assets that do not fit into the conventional equity and shares, fixed income and bonds, or cash categories. Alternative investments include, but are not limited to; crypto, property, commodities like precious metals or energy, collectibles such as art or fine wine, and private equity.

|

Alternatives Heat Up

Despite the challenges facing investors right now, demand for alternative investments is expected to remain elevated. Our survey found that over half (58%) of UK investors currently hold at least one alternative investment in their portfolio with those investing in alternatives expected to increase their monthly investments by 11% on average. As the home of precious metals investing, The Royal Mint saw a 10% uplift in gold investments as more investors moved into the ‘safe haven’ asset in the first half of 2023.

More activity is anticipated in the months ahead. 36% of those who haven’t previously invested in alternatives said they would consider investing in the asset class in the future. The market is being driven by retail investors looking to generate better returns in light of high inflation and the pressures of high interest rates. Furthermore, many are investing spare savings or increased earnings from pay rises this year to increase their monthly investments.

The high growth potential of alternatives means they are seen as increasingly attractive to investors and becoming a popular investment choice. One such example is gold, which has delivered annualised returns of 10.05% over the last 20 years. A gold Sovereign coin purchased 5 years ago would have been valued at £215, but is now worth over £370, a rise of 72%.1 Some see UK coins such as Sovereigns and Britannias as a particularly attractive way to invest in gold due to their status as legal tender, meaning they are exempt from Capital Gains Tax in the UK. The Royal Mint has seen a 17% year-on-year uplift in first-time precious metals investors during the first half of 2023.

With a number of tailwinds behind alternatives, it is no surprise that many younger investors are flocking to the asset class. Momentum is growing too… over half (58%) of GenZ investors who hadn’t invested in alternatives stated they were considering investing in alternatives in the future. Nearly a third (31%) of Gen-Z investors said they were motivated by the opportunity to build their wealth.

Gen-Z investors in particular appear to be allocating a greater share of their portfolios to alternatives. 64% of Gen-Z investors hold at least one alternative investment in their portfolio with 33% currently holding crypto and 18% holding gold. As a new generation starts its journey with alternatives, investor appetite looks robust for the years ahead.

There are some signs that recent momentum behind alternatives will continue to build and ramp up in the future. At The Royal Mint, we have welcomed tens of thousands of new investors in recent years who are starting their investment journey in precious metals, whether this is via our bullion coins and bars or our digital product offering. Gold and other precious metals are increasingly becoming a mainstream choice for investors who are looking to diversify their portfolio and hedge against inflation.

Find out more about gold investing and precious metals here: https://www.royalmint.com/invest/get-into-gold/

The contents of this article, accurate at the time of publishing, are for general information purposes only, and do not constitute investment, pensions, legal, tax, or any other advice. Before making any investment or financial decision, you may wish to seek advice from your financial, pensions, legal, tax and/or accounting advisors.

This article may include references to third-party sources. We do not endorse or guarantee the accuracy of information from external sources, and readers should verify all information independently and use external sources at their own discretion. We are not responsible for any content or consequences arising from such third-party sources.