During economic turmoil and periods of uncertainty, investors often start to review and recalibrate their investments in order to ‘weather-proof’ their portfolio. This can be driven by a number of factors but news around geopolitical events and stock market turmoil often creates pressure on investors to sell their assets.

Economic uncertainty, increasing talk of a global recession, and unstable financial markets are all factors at play right now which have forced many to rethink their finances and investments this year. Our research shows that two-thirds (63%) of UK investors have become more concerned about their investment risk and returns since the cost-of-living crisis started.

While choppy investment markets can create a selling frenzy, it also pushes more investors to consider whether their portfolio is positioned to benefit over the long-term. Prioritising long-term growth over short-term market movements can enable investors to ride bumps in financial markets and give investments enough opportunity to grow over multiple years.

Our data shows that 26% of investors surveyed were motivated to invest in alternatives investments such as gold, bitcoin, and property because they want to build their wealth over the long-term. We explore why assets traditionally viewed as ‘alternative investments’ appeal to investors looking to build wealth and secure better returns in the long run.

The Portfolio Balancing Act

The 60:40 investment portfolio, allocating 60% of a portfolio to stocks and shares and 40% to fixed income, has been the traditional playbook for asset managers. However, in the current period of high inflation and high interest rates, the correlation between these assets has been put to the test by markets. Blackrock research shows that over the last two years, the 10-year US Treasury yield has, on average, delivered negative returns on days when equities have fallen.

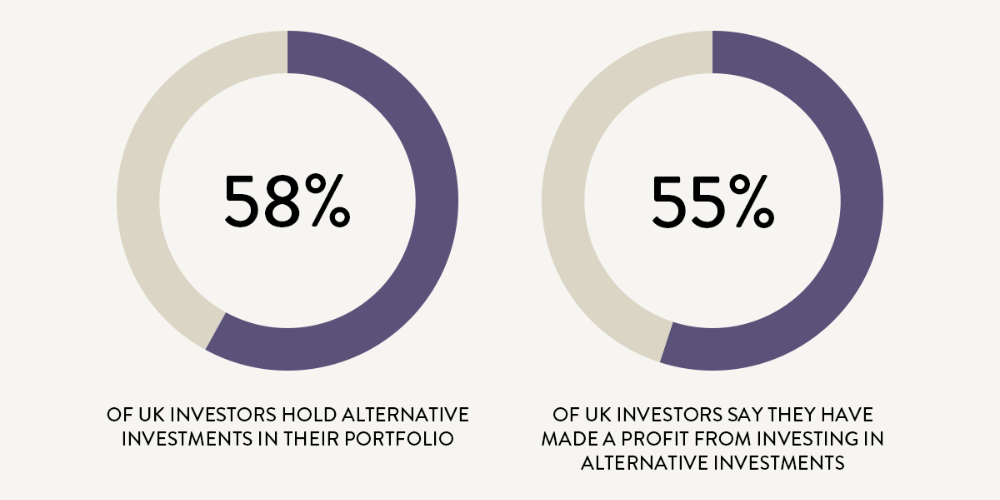

As investors increasingly look to construct resilient and durable portfolios, many are considering non-traditional investments and broader opportunities to target returns over the long-term. By including non-traditional asset classes in their portfolio, it provides an opportunity for investors to diversify their portfolio and spread their investment risk.

With low correlation to traditional asset classes, alternatives can be a beneficial way to diversify your portfolio and avoid overexposure to any one particular asset class. The World Gold Council now suggest putting around 2–10% of a portfolio into the ‘safe-haven’ of investment gold in order to benefit from portfolio diversification.

Finding Long-Term Returns

The average rates on one-year and longer-term fixed rate bonds, and fixed-rate ISAs have tipped over 5% for the first time since 2008.5 However, our research shows that nearly three quarters (71%) of UK investors are now looking for better returns from their investments because high inflation is eroding the value of their returns. Our research also indicates that many investors are turning to alternative investments during this period to enhance the total return of their portfolio through access to a broader base of investments. While cash savings are returning 5% with little risk in an environment where inflation is above 6%, investors are increasingly willing to look for greater returns despite the higher risk that comes with investing.

So far this year, gold has returned 1.4% to investors (GBP per troy ounce) but in the long-term, the asset has delivered annualised returns of 10.3% over the last 20 years. This compares against UK stocks which have delivered annualised returns of 5% and returned 1.4% this year. Last year at The Royal Mint, we saw a near 26% uplift year-on-year in the volume of gold investments with investors moving into precious metals to improve the returns profile of their portfolio. Gold is now becoming a more mainstream investment choice for many UK investors.

Finding a Pragmatic Approach

It is important to build a resilient and durable portfolio to weather periods of economic uncertainty. Not having ‘all your eggs in one basket’ and ensuring your investments are suitably diversified will likely improve the opportunities to deliver more consistent portfolio growth over the long-term. Investors are becoming more pragmatic about their portfolios and turning towards investments including gold and other precious metals in order to build wealth over the long-term.

The contents of this article, accurate at the time of publishing, are for general information purposes only, and do not constitute investment, pensions, legal, tax, or any other advice. Before making any investment or financial decision, you may wish to seek advice from your financial, pensions, legal, tax and/or accounting advisors.

This article may include references to third-party sources. We do not endorse or guarantee the accuracy of information from external sources, and readers should verify all information independently and use external sources at their own discretion. We are not responsible for any content or consequences arising from such third-party sources.

References:

- https://www.royalmint.com/aboutus/press-centre/investors-move-into-safe-haven-gold-as-market-uncertainty-remains-new-royal-mint-data-reveals/

- Appetite for Alternative Investments Increasing (royalmint.com)

- https://www.blackrock.com/us/individual/insights/60-40-portfolios-and-alternatives

- https://www.royalmint.com/invest/get-into-gold/

- https://www.thisismoney.co.uk/money/saving/article-12531575/Savings-rates-hit-highest-levels-2008-close-peak.html

- https://www.lbma.org.uk/prices-and-data/precious-metal-prices#/table

- https://www.londonstockexchange.com/indices/ftse-100