Given the size of the US economy, the US’s role on the world stage, and the status of the US Dollar in international trade, it’s no surprise that US elections can have a significant impact on global markets and the demand for gold.

Gold is traditionally considered a safe-haven asset and demand for gold is therefore highly sensitive to economic uncertainty, geopolitical developments, and the relative strength of the US Dollar. Actions taken by American Presidents and members of Congress can impact these profoundly, with consequences for gold investors the world over.

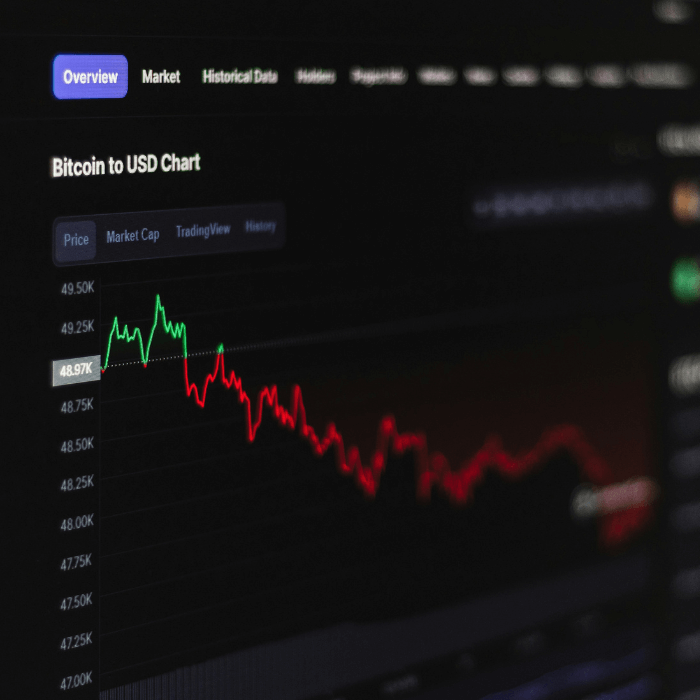

1. Market Volatility and Economic Uncertainty

Many investors wishing to make outsized returns look to position their portfolios to benefit from any changes in monetary or fiscal policy, or to the broader economic and business environment. New Presidents and members of Congress may bring new priorities in terms of taxing, spending and regulations – and in the run-up to elections uncertainty about who will be setting the agenda can drive investors to safe-haven assets like gold.

This is particularly true if the polls are close. For instance, in 2016 most polls suggested that Hilary Clinton was likely to defeat Donald Trump. The surprise victory of Donald Trump led to a temporary spike in gold prices as markets reacted to the unexpected outcome. Similarly, the 2020 election between Trump and Biden saw gold prices fluctuate as delays in the counting of votes and fears of post-election instability created market anxiety.

2. Geopolitical Implications

The outlook of US presidential candidates on issues of foreign policy can have a significant impact on investors’ portfolios. The geopolitical environment can become more volatile around elections. Different candidates may propose vastly different approaches to international relations, trade, and defence, while other nations can sometimes appear to be more or less likely to pursue certain policies until the outcome of the election is known. All of this can influence investor sentiment towards gold.

During the 1980 election, Ronald Reagan's tough rhetoric against the Soviet Union and the promise of boosting the US military raised concerns about the potential for conflict, leading to an increase in safe-haven gold buying which helped to push gold prices to record highs. In 2024, the candidates’ approaches to wars in the Middle East and Europe, and US relations with China have the potential to move gold prices in either direction.

3. Strength of the US Dollar

The strength of the US dollar is closely tied to gold prices, as gold is typically priced in dollars when traded on the international market. A stronger US dollar (relative to other currencies) usually leads to a decrease in gold prices, while a weaker dollar tends to boost gold prices. US elections can impact the dollar's strength by influencing economic policies.

Immediately after the 2008 election which saw Barack Obama defeat his Republican rival John McCain, the prospect of stimulus measures intended to combat the financial crisis initially led to a weaker dollar, which in turn contributed to a significant rise in the gold price. In 2024 there has been some discussion about whether a deliberate policy of weakening the US dollar may benefit the US by boosting exports.

Regardless of how a new president actually governs, historical patterns show that gold often benefits from the uncertainty surrounding elections. As such, gold remains a trusted asset for investors looking to hedge against the uncertainties that US elections can bring to global markets.

Notes

The contents of this article are accurate at the time of publishing, are for general information purposes only and do not constitute investment, legal, tax or any other advice. Before making any investment or financial decision, you may wish to seek advice from your financial, legal, tax and/or accounting advisers.

This article may include references to third-party sources. We do not endorse or guarantee the accuracy of information from external sources, and readers should verify all information independently and use external sources at their own discretion. We are not responsible for any content or consequences arising from such third-party sources.