The Case for Silver Investment

Category: Invest

In the varied landscape of investment opportunities, silver stands out as a timeless asset with a unique allure. An element that has long been used as a monetary metal, taking a junior role to that of gold.

Often overshadowed by its glamorous counterpart, gold, silver has quietly been gaining traction among investors, bolstered by a myriad of factors that paint a bullish picture for its future prospects.

As we navigate through the complexities of today's economic environment, let’s consider the reasons why silver is shining brightly in the eyes of investors:

Industrial Demand Surge

Silver's utility extends far beyond its role as a precious metal. With exceptional conductivity, reflectivity, and antibacterial properties, silver plays a vital role in various industrial applications. The burgeoning demand for electronics, solar panels, and automotive components, coupled with advancements in technology, has propelled silver into the forefront of industrial consumption. As the world transitions towards cleaner energy solutions, the demand for silver in solar panels is expected to witness exponential growth, further bolstering its industrial appeal.

What is Silver Used For? | The Royal Mint

Inflation Hedge

In times of economic uncertainty and inflationary pressures, investors seek refuge in tangible assets that retain their value over time. Historically, silver has served as a reliable hedge against inflation, offering protection against the erosion of purchasing power. With central banks adopting accommodative monetary policies and governments injecting stimulus into economies worldwide, concerns regarding lingering inflationary pressures have heightened. In such a scenario, silver emerges as a compelling hedge, preserving wealth and mitigating the adverse effects of inflation.

Supply Constraints

Unlike fiat currencies, which can be printed at will, the supply of silver is inherently limited. While silver is mined as a byproduct of other metals such as copper and zinc, primary silver mines contribute a relatively small portion to global supply. Furthermore, dwindling ore grades and increasing extraction costs (mainly energy consumption) have constrained the growth of silver production. In contrast, demand for silver continues to surge, creating a supply-demand imbalance that bodes well for price appreciation in the long run.

However, it is appropriate to balance this supply argument by pointing out that as silver demand (and price) increase, greater volumes of above ground recycled silver will likely come to market and satisfy the rise in demand.

https://www.royalmint.com/e-waste-service/

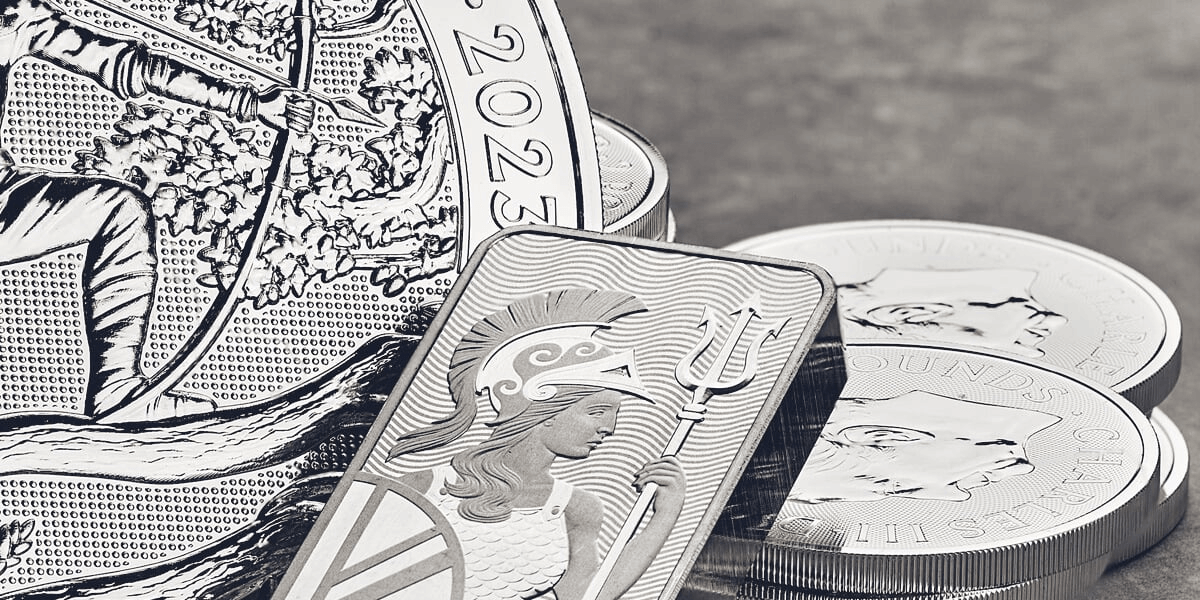

Investment Demand

In an era marked by financial innovation and accessibility, investors are increasingly diversifying their portfolios to include alternative assets such as silver. The proliferation of exchange-traded funds (ETFs/ ETCs) and bullion coins has democratized access to physical silver (and precious metals) investments, attracting a broader investor base. Moreover, the growing interest in sustainable and ethical investments has led to heightened demand for environmentally friendly assets like silver, further fuelling its appeal to the investor community.

Global Silver Demand Forecasted to Rise to 1.2 Billion Ounces in 2024 | (silverinstitute.org)

Macroeconomic Uncertainty

Geopolitical tensions, trade disputes, and the lingering impacts of the COVID-19 pandemic have cast a shadow of uncertainty over global markets. In such turbulent times, investors gravitate towards safe-haven assets with intrinsic value and a proven track record of resilience. Silver, with its dual role as a precious metal and industrial commodity, offers a compelling investment proposition in times of macroeconomic uncertainty, offering stability and diversification to investment portfolios.

Physical precious metal investments (off-exchange) also provides some diversification away from systemic and counterparty risks associated with investing in listed securities. At The Royal Mint, we have one of the most secure vaulting sites in Europe, isolated away from any major population centre.

The Case for Investing in Silver Over Gold - Bloomberg

Summary

In conclusion, the bullish case for silver is underpinned by a convergence of fundamental factors that underscore its intrinsic value and investment appeal. From its indispensable role in industrial applications to its time-tested status as a store of value, silver stands poised to shine brightly in the years to come.

It’s worth mentioned that a long held price ratio between gold and silver exists, which at the current time is considered quite stretched, where one ounce of gold would currently buy you 88 ounces of silver. The 30 year average is purported to be closer to 67and thus suggesting the price differential may be primed for a move back towards its mean. The Case for Investing in Silver Over Gold - Bloomberg. At the time of publication, Silver trade around a spot price of £22.3 (USD: $28).

Whether one seeks to hedge against inflation, diversify their investment portfolio, or capitalize on burgeoning industrial demand, silver presents an enticing opportunity for investors seeking exposure to a resilient and promising asset class. As the adage goes, "every cloud has a silver lining," and in the realm of investments, silver shines as a beacon of stability and opportunity amidst the uncertainties of today's globalised economy.

The Royal Mint offer a wide variety of silver bullion bars and coins (CGT exempt), which combines quality craftsmanship and with world class vaulting arrangements. To learn more, please visit our Silver Bullion page.

Notes

The contents of this article are accurate at the time of publishing, are for general information purposes only and do not constitute investment, legal, tax or any other advice. Before making any investment or financial decision, you may wish to seek advice from your financial, legal, tax and/or accounting advisers.

This article may include references to third-party sources. We do not endorse or guarantee the accuracy of information from external sources, and readers should verify all information independently and use external sources at their own discretion. We are not responsible for any content or consequences arising from such third-party sources.

Sources:

As above and:

https://www.royalmint.com/invest/discover/invest-in-gold/an-introduction-to-silver-investment/

https://www.royalmint.com/invest/discover/invest-in-gold/gold-and-silver-a-buyers-guide/

https://www.royalmint.com/invest/discover/silver-news/how-else-is-silver-used/